The best Side of Chapter 7 Bankruptcy

But, since they’re not permitted to Speak to you specifically when the situation has been submitted, you’ll most likely not hear from them in any way.

Bankruptcy guidelines understand that you ought to be permitted to maintain specified assets in Chapter seven bankruptcy. This home is secured through exemptions. Exemptions protect all types of authentic and private home nearly a certain sum. Own residence consists of appliances, apparel, textbooks, and jewellery.

Irrespective of where you live, you can usually file your documents in person or mail them to the court. In the event you’re filing in person, take your documents to the court docket clerk’s Office environment.

Most Chapter seven situations don’t have any participation by unsecured creditors. Should the trustee notifies the court and your creditors that assets will be marketed and money dispersed to creditors, They could file a evidence of assert.

Ahead of the court discharges your debt, you should take a debtor training system. This class handles financial management expertise and instruments to help you get essentially the most within the new start off bankruptcy supplies.

Richard Bolger and his team had been pretty Specialist and comprehensive. It was a satisfaction working with this legislation organization. Judith R. Look at investigate this site full evaluation in this article

When you’re facing substantial debt and you’re worried you can’t pay out it, you may want to think about filing for bankruptcy go to my site to get a economical contemporary get started.

Although no one really wants to spend attorney service fees, it see page may be well worth doing if your circumstance is difficult. And recall, Price isn’t the only thing to think about when using the services of a over at this website lawyer. Most bankruptcy attorneys offer a free of charge initial session.

Neuralyzer. Amnesia with regard to the suffering of a process is perfect for childbirth — so we’ve been advised — but wretched for residing a submit-bankruptcy life.

A few of the real difference is often stated by this primary hurdle: Not all Chapter seven applicants qualify for bankruptcy; the court docket applies a “indicates examination” to each Chapter 7 filing.

One method to prevent bankruptcy is to amass a minimal interest amount mortgage and pay back all that basically expensive debt. Upstart understands that a credit rating score isn't the only variable to think about when evaluating your personal loan software.

In Chapter 13, several of your credit card debt is forgiven, but provided that you satisfy the problems authorised through the trustee and bankruptcy decide.

If All of this Seems challenging, or blog here you’re certain you’ll should be coached up routinely, get that has a nonprofit credit rating counseling agency.

Bankruptcy can harm your credit score rating. Chapter seven bankruptcy can continue to be on your credit rating report for around 10 years — while if bankruptcy is actually a practical selection, chances are your credit rating is presently tarnished.

Edward Furlong Then & Now!

Edward Furlong Then & Now! Anthony Michael Hall Then & Now!

Anthony Michael Hall Then & Now! Burke Ramsey Then & Now!

Burke Ramsey Then & Now! Batista Then & Now!

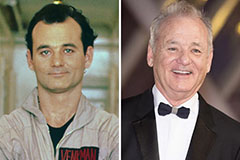

Batista Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now!